Feature

Report: What Record SEC and FINRA Enforcement Actions Mean for 2016

Wednesday, March 23, 2016In another record year for enforcement actions, the US Securities and Exchange Commission (SEC) in 2015 saw high-impact and first-of-their-kind cases that spanned the securities industry. Meanwhile, at the Financial Industry Regulatory Authority (FINRA), total fines in 2015 were down, but the amounts FINRA ordered to be paid in restitution to injured investors tripled compared to the prior year.

These results and more are part of the 2015 Year in Review: Select SEC Cases and FINRA Developments and Enforcement Cases prepared by Morgan Lewis’s Securities Enforcement and Litigation and Investment Management lawyers. The 10th annual report points to key trends and actions affecting broker-dealers, investment advisers, investment companies, and their employees during 2015, and looks at what clients can expect in 2016. Reach out to partners Amy Greer, Jen Klass, or Merri Jo Gillette with questions and scroll down for a Q&A discussing the highlights.

SEC: 2015 Enforcement Actions and Look Ahead

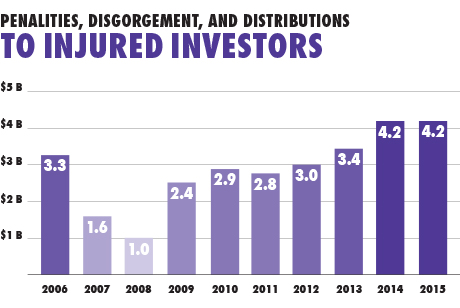

The SEC in fiscal 2015 filed a record 807 enforcement actions and obtained orders totaling $4.2 billion in penalties and disgorgement; that compares with a record 755 actions and $4.16 billion in 2014, and 676 actions and $3.4 billion in 2013. The SEC’s Division of Enforcement has focused its efforts on new and innovative actions to expand its footprint and strengthen the deterrent effect of its enforcement program.

We can anticipate continued focus in 2016 on the use of data analytics to direct the SEC’s resources toward areas with the highest likelihood or risk of misconduct. In January, the SEC announced its 2016 regulatory priorities, which reflect its goal of protecting investors by focusing on risk areas, including those related to investment advisers and investment companies, investors saving for retirement, cybersecurity, market structure issues, and suspicious activity.

The SEC’s first-of-their-kind cases in 2015 included the first time an SEC enforcement action has involved the following:

- A private equity adviser’s misallocation of broken deal expenses

- An underwriter’s pricing-related fraud in the primary market for municipal securities

- A “Big Three” credit rating agency

- Violations arising from a dark pool’s disclosure of order types to its subscribers

- A Foreign Corrupt Practices Act (FCPA) action against a financial institution

- An admissions settlement with an auditing firm

- The SEC’s Whistleblower Rules

FINRA: 2015 Developments and 2016 Outlook

Major personnel changes are afoot at FINRA this year. Chief among them is Chairman and CEO Richard Ketchum’s plan to retire in the second half of 2016. The board of governors will conduct a search for his successor with a consideration to FINRA and outside candidates.

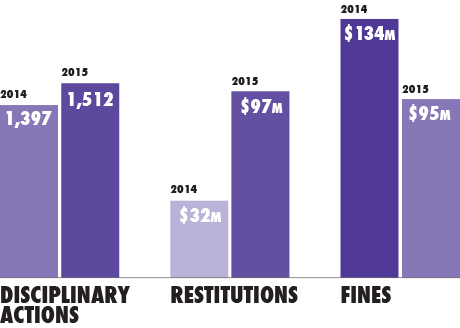

Although FINRA instituted more disciplinary cases in 2015 than in 2014, the total fines levied were significantly lower in 2015 than in the prior year. In contrast, the amount of restitution FINRA ordered in 2015 nearly tripled.

In 2015, FINRA brought 1,512 new disciplinary actions, an increase from the 1,397 cases initiated in 2014. Last year, FINRA levied $95 million in fines, down from $134 million in 2014, and ordered $96.6 million to be paid in restitution to harmed investors—nearly triple the 2014 total of $32.3 million.

FINRA also made more than 800 fraud and insider trading referrals to the SEC and other agencies for investigation and/or prosecution, up from more than 700 such referrals in 2014.

FINRA Enforcement

Year-on-Year Comparison

In its January 2016 regulatory and examination priorities letter, FINRA identified supervision, liquidity, and firm culture as broad themes for the upcoming year. As in previous years, the agency will focus on senior citizens and vulnerable investors (an area where FINRA has proposed new rules), suitability and concentration, fixed-income orders, market access, and sales charge discounts and waivers. New priorities for 2016 include firm culture, conflicts of interest, supervision of technology, and anti-money laundering controls.

Q&A WITH OUR PARTNERS

New York partners Amy Greer and Jen Klass and Chicago partner Merri Jo Gillette took a moment to discuss the report with us and talk about what’s ahead.

What is the key takeaway for clients from this joint SEC/FINRA year in review?

Compliance, technology, and data analytics—as well as assets invested for retirement—are all themes that repeat in both this past year’s cases and in the priorities of each of the regulators. There is no question that we will continue to see more of the issues related to these themes in 2016.

What important developments should clients prepare for in 2016?

The regulators expect not only that firms will ensure the safety, security, and regulatory compliance of their technology, since all of our clients now run their businesses on complex electronic systems, but also that firms will be fully prepared for regulatory changes and market changes—whether those changes come in the form of interest rate movements, market volatility, or changes like the proposed fiduciary rule.

What are the strengths that distinguish the Morgan Lewis Securities Enforcement and Litigation practice?

Our practice has an enormous depth and breadth of subject matter experience, as well as many years of experience practicing both within these regulators and representing our clients in front of these regulators. That experience affords clients an advantage when interfacing with SEC or FINRA staff. Based on prior experience working for regulators, Morgan Lewis partners have valuable insights on how to position our clients for the best outcome at every stage of an examination or investigation.

Describe what the Investment Management team does and how it helps clients in these matters?

The Investment Management team provides subject matter experience on a full range of compliance, regulatory, formation, investment, and transactional issues to our financial industry clients. The Investment Management team helps clients work to create compliant structures and vehicles; keep those financial industry clients, services, and funds in regulatory compliance; and, in connection with regulatory examinations and investigations, the Investment Management team partners with our Securities Enforcement lawyers to ensure that our clients benefit from that deep subject matter capability.

ACCOLADES

- Powerhouse Honor Roll, Securities & Finance Litigation, BTI Consulting Litigation Outlook (2015)

- Securities Litigation Law Firm of the Year, US News & World Report/Best Lawyers (2013)

- Most Recognized for Client Service, BTI Client Service A-Team (2016)