LawFlash

Directors’ and Officers’ Liability in Kazakhstan | Ответственность должностных лиц частных компаний в Казахстане

July 22, 2019Directors and officers of private companies are responsible for managing and running business. This responsibility is not limited to disciplinary liability (such as termination of employment), but also involves civil law liability (such as payment of damages) as well as administrative and even criminal liability. In some cases, the liability may be broad and contain no reasonable exceptions that might be available in other jurisdictions. This LawFlash summarizes the extent of liability that company directors and officers could face under Kazakhstan law.

In general, Kazakhstan legislation regulating issues of directors’ and officers’ liability is still under development.

Officers in JSC[1] and LLP[2]

According to the JSC Law[3], an officer is

- a member of the board of directors;

- a member of the executive body;

- a person solely performing functions of the executive body (CEO).

According to the LLP Law[4], an officer is

- a member of the supervisory board;

- a member of the executive body;

- a person solely performing functions of the executive body (CEO).

In other words, in the context of respective laws on JSC and LLP, definitions of officers are rather limited. For example, pursuant to judgment No. 2-935/15 dated 13 March 2015, the chief accountant was not considered to be an officer.

This approach regarding officers under Kazakhstan law differs from that of other jurisdictions. For instance, under Russian corporate law[5], there is no such term as an “officer.” Members of governing bodies (members of executive bodies, board of directors (supervisory boards)) may face civil law liability. The concept of an “officer,” in the sense used under Kazakhstan law, is used in the Russian administrative law.[6] The criminal law contains the term “a person exercising management functions in commercial or other organization.”[7] The Criminal Code also contains the term “officer,” but it is used in a different meaning.[8] Russian law does not separate administrative and criminal liability of officers depending on the legal form of the company.

We note that, similar to Russian law, a broader definition of officers is given in the Law on Bankruptcy[9], and in the Code of Administrative Offences[10] and Criminal Code[11]. Therefore, in the context of bankruptcy or administrative or criminal liability, other persons may also be held liable as officers.

Officers’ Liability in JSC

Provisions on officers’ liability in JSC are set out in the JSC Law. Please see Appendix No. 1 containing respective provisions of the JSC Law.

In general, officers bear liability for losses incurred by JSC. According to the Civil Code[12], the term “losses” means

- expenses which have been or should have been incurred by a person whose right has been violated, loss of or damage to the property (real damage); and

- non-derived income, which a person would have received in normal turnover conditions if his/her right has not been violated (lost profit).

In other words, as a general rule, officers are held liable for both real damage and lost profit.

Officers’ liability can occur not only for active acts (for example, decisionmaking) but for passive acts as well (such as an omitted act or even the offer to enter into some categories of transactions).

In the context of bringing officers to liability, the JSC Law contains such terms as “in bad faith” and “omission”:

- “acting in bad faith (negligently)” means making a decision on entering (offer to enter) into major transactions and/or interested-party transactions adverse to the interests of the JSC, in violation of the principles of officers’ activity established in the JSC Law, as a result of which the JSC suffers losses not covered by the inherent business risk (although the JSC Law contains no definition of “inherent business risk”); and

- “omission” means that the company’s officer abstained while making a decision on entering into major transactions and/or interested-party transactions, as a result of which the JSC suffers losses not covered by the inherent business risk, or did not participate in the voting without a reasonable excuse (in other words, a mere missing of meeting of the management body may turn out to be an insufficient ground for officer release from liability). Accordingly, JSC officers are released from liability in case they voted against the decision adopted by the JSC body which resulted in losses for the JSC or shareholder or did not participate in the voting with a reasonable excuse.

An officer is released from reimbursement of damages occurring as a result of a business (entrepreneurial) decision (the term is not defined in the JSC Law), if it is proved that the officer

- acted prudently and abided by the principles of JSC officers’ activity established by the JSC Law;

- acted on the basis of up-to-date (proper) information at the time of decisionmaking; and

- reasonably believed that such decision is in the JSC’s best interests.[13]

Officers’ Liability in LLP

Provisions on officers’ liability in LLP are less regulated than those for JSC officers. Thus, the LLP Law contains no reasonable grounds for release from liability (for example, business/entrepreneurial decision, inherent entrepreneurial risk, etc.), and it does not define the term “in bad faith.”

The LLP Law contains general provisions in respect of bringing officers to liability:

- Officers may be held liable on demand of any of the LLP participants (and the LLP itself) for reimbursement of damages caused by them to the LLP (they bear joint and several liability for the losses caused by joint negligent management of the LLP) (Please see, e.g., court judgments No. 2а-5150 dated 1 November 2017, No. 1513-16-00-2/1967 dated 24 November 2016, No. 3514-16-00-2/3203 dated 1 November 2016, No. 4712-18-00-2/907 dated 6 June 2018, etc.)

- Officers may be brought to subsidiary liability with LLP to third persons for the losses suffered by those persons due to insolvency (bankruptcy) of LLP caused by negligent execution of duties by members of the executive management body of LLP (Please see, e.g., court judgments No. 7599-16-00-2а/281 dated 17 February 2016, No. 2А –1331/2016 dated 16 March 2016, No. No. 4712-18-00-2/907 dated 8 June 2018, No. 5501-17-00-2/1008 dated 1 June 2017, etc.)

- Further, members of the executive body may be brought to liability (reimbursement of losses) on demand of LLP participants in case of a breach by them (or their relatives) of conflict-of-interest-related restrictions, for example, in case of violation of the restriction on entering by LLP, in absence of consent of the general meeting, into transactions aimed at receiving property benefits (please see, e.g., court judgments No. 2а-167-13 dated 20 February 2013, No. 7527-17-00-2/10781 dated 15 November 2017, etc.)

In general, Kazakhstan law on civil liability of officers in JSC and LLP are similar to provisions of Russian law on liability of persons comprising governing bodies of companies. Thus, as a general rule, there is liability for wrongful actions (inactions) if it is proved that in the course of exercising his/her rights and duties the officer acted in bad faith or unreasonably, including if his/her actions (inactions) were inconsistent with the ordinary civil turnover or customary business risks. The terms “bad faith” and “unreasonable” are not defined in Russian law. However, these terms were clarified in the law enforcement practice.[14]

Bankruptcy

The legislation provides for a number of specific cases regarding officers’ liability. Thus, officers bear subsidiary liability for deliberate and false bankruptcy of the legal entity, when the bankruptcy occurred because of an action (omission to act) of officers:

- Deliberate bankruptcy is an intentional creation or escalation of insolvency as a result of an action (omission to act) of the founder (a participant), an officer, bodies of the legal entity, or an individual entrepreneur committed in his/her own personal interests or in the interests of third parties

- False bankruptcy is a knowingly false announcement as a result of an action and/or a decision of the founder (a participant), an officer, bodies of the legal entity, or an individual entrepreneur about his/her insolvency purporting to mislead creditors with a view of getting extension or deferral of payments due to creditors, or debts relief, or non-payment of debts (please see, e.g., court judgments No. 02-13215/15 dated 21 December 2015, No. 7199-16-00-2а-4 dated 24 August 2016, No. 02-14047/15 dated 5 January 2016, No. 7119-16-00-2/1804 dated 18 April 2016, No. 6309-17-00-2/2554 dated 3 August 2017, No. 7119-16-00-2/4530 dated 24 June 2016)

According to the Bankruptcy Law:

- an officer of the bankrupt company must reimburse losses to the owner of its property for deliberately bankrupting the debtor;

- for violation of certain rules of the Bankruptcy Law (for example, breach of duty to apply to the court for bankruptcy recognition), where the debtor’s property is insufficient to satisfy claims of all creditors, the officers of the debtor (who are responsible for execution of this duty) jointly bear subsidiary liability.

The definition of officers covered by the Bankruptcy Law is much broader than the lists given in the JSC Law and LLP Law. According to the Bankruptcy Law an officer is

- a member of the board of directors;

- a director (deputy director) of the legal entity being an insolvent debtor;

- any other person being a member of the collegial executive body of the legal entity entrusted with permanent or temporary authorities to supervise the legal entity;

- a chief accountant (deputy chief accountant) of the legal entity being an insolvent debtor, or any other person temporarily fulfilling this function.

Administrative and Criminal Liability

In addition to the civil law liability (and special liability under the bankruptcy legislation), officers may also face administrative and criminal liability.

Under the Code of Administrative Offences, officers are defined as the persons who are

- permanently, temporarily, or under special power performing now or at the time of the administrative offence the functions of the public authority representative; or

- performing now or at the time of the administrative offence any organizational and management or administrative and economic functions in state institutions, quasi-public entities, local governments (in this context we note that a quasi-public entity is a very broad term comprising state enterprises, LLPs, JSCs, including national management holdings, national holdings, national companies where the state (government) is a founder, a participant, or a shareholder, including subsidiaries, dependent, or other affiliated legal entities in accordance with legislation).

A similar definition is given in the Criminal Code. An officer is a person who is

- permanently, temporarily, or under special power performing the functions of the public authority representative; or

- performing any organizational and management or administrative and economic functions in government authorities, local governments, and armed forces of the Republic of Kazakhstan, other military forces, and troops of Kazakhstan.

In particular, an officer may be held liable for administrative and criminal offences and crimes, e.g., in the following areas:

- Employment

- Tax

- Environmental

- State procurements

- Fire safety

An officer faces administrative liability in case of committing an administrative offence related to failure to perform or improper performance of employment (office) duties. In absence thereof, an officer guilty for the administrative offence is held liable on the regular equal basis. According to court practice, failure to perform or improper performance of employment duties entails administrative liability for both members of the executive body (please see, e.g., court judgments No. 3-10420 /2012 dated 7 December 2012, No. 3-7564/12 dated 31 August 2012, No. 3-6566/12 dated 3 August 2012, No. 3-5908 /2012 dated 20 July 2012), and accountant (please see as an example judgments No. 4615/2-2012 dated 14 August 2012, No. 3-7213/12 dated 7 September 2012, No. 3-8190/12 dated 24 September 2012, No. 3-6707 /2012 dated 7 August 2012). In some cases, heads of particular subdivisions in the legal entity, for example, a head of economic department (please see, e.g., court judgment No. 3-3567/10 dated 7 April 2010) may face administrative liability.

Annex No. 1 – Liability of JSC Officers

Liability for Losses

Officers are held liable for losses suffered by the JSC. Losses for which officers are liable include, but are not limited to, those incurred as a result of

- provision of deliberately false or misleading information;

- violation of the procedure for provision of information as established in the JSC Law;

- offer to enter into major transactions and/or interested-party transactions which caused losses to the JSC for the negligent actions and/or omission, including with a view of obtaining by them or their affiliates of profit as a result of entering into such transactions with the JSC. Taking by the general meeting of a resolution on entering into a major transaction and/or interested-party transaction does not release the officer who offered its conclusion from liability if—as a result of entering into such transactions—the JSC suffered losses;

- taking a resolution on entering into major transactions and/or interested-party transactions which caused losses to the JSC due to negligent actions and/or omission, including with a view of obtaining profit (deriving income) by them or their affiliates as a result of entering into such transactions with the JSC. Taking by the general meeting of a resolution on entering into a major transaction and/or interested-party transaction does not release from liability the officer who acted negligently (in bad faith) and/or failed to act at the meeting of the JSC body of which he/she was a member, including with the aim of receiving profit by them or their affiliates, where the JSC suffered losses as a result of consummation thereof.

Qualification Characteristics of Certain Categories of Transactions

- The JSC may go to court with a claim of liability against an officer for the damage caused to the JSC as a result of entering into an interested-party transaction through which the JSC acquired or disposed of the property the value of which is 10% and more of the total book value of its assets, and if it is proved that—at the time of the decision on entering into the transaction—the value of such property was apparently disproportionate to its market value determined by the appraiser in accordance with the Law On Appraisal Activity in the Republic of Kazakhstan.

- The JSC may go to court with a claim against an officer on reimbursement to the JSC of damages caused by him/her to the JSC, and on returning to the JSC by the officer and/or his/her affiliates of profit received as a result of a decision on entering (offer to enter) into major transactions and/or interested-party transactions that caused losses to the JSC, in case the officer acted in bad faith and/or failed to act.

- The JSC may go to court with a claim against an officer of the company and/or any third party on reimbursement to the JSC of losses caused to the JSC as a result of a transaction concluded by the JSC with such third party, if—at the time of entering into and/or consummation of such transaction—the JSC officer acted by agreement with such third party in violation of legislation, charter, and internal documents of the JSC, or his/her employment contract. In this case, the said third party and JSC officer act as joint and several debtors to the JSC for reimbursement to the JSC of such losses.

- Where the JSC’s financial statements distort the financial position of the JSC, officers who signed such financial statements are held liable to third parties suffering material damage.

Release of JSC Officers from Liability

- JSC officers are released from liability if they voted against the decision of the JSC body which resulted in losses of the JSC or shareholder, or didn’t participate in the voting with a reasonable excuse (release does not apply to the officer who was interested in consummation of the transaction and offered consummation of the transaction resulting in losses of the JSC);

- An officer is released from reimbursement of damages occurring as a result of a business (entrepreneurial) decision, if it is proved that the officer acted prudently and in compliance with the principles of officers’ activity in the JSC established by the JSC Law, on the basis of up-to-date (appropriate) information as of the time of decisionmaking, and reasonably believed that such decision is in the best interests of the JSC.

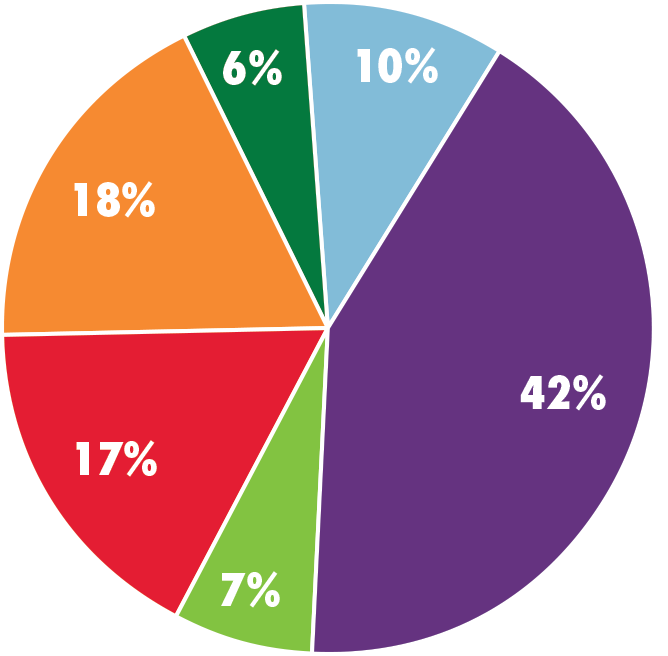

Annex No. 2 – Court Judgments (Categories of Liability)*

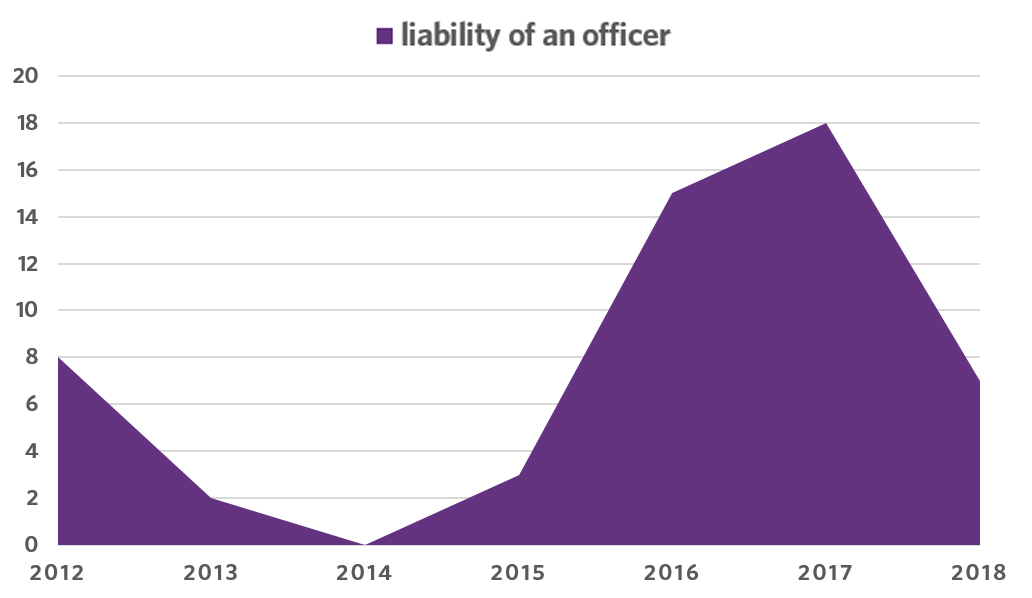

Annex No. 3 – Court Judgments (Statistics Per Year)*

CONTACTS

If you have any questions or would like more information on the issues discussed in this LawFlash, please contact any of the following Morgan Lewis lawyers:

Almaty

Aset Shyngyssov

Bakhytzhan Kadyrov

Arailym Azhikhanova*

*Legal assistant Arailym Azhikhanova contributed to this report.

[1] Joint Stock Company (JSC).

[2] Limited Liability Partnership (LLP).

[3] Law of the Republic of Kazakhstan dated 13 May 2003 No. 415-II “On Joint Stock Companies” (JSC Law).

[4] Law of the Republic of Kazakhstan dated 22 April 1998 No. 220-I “On Limited and Additional Liability Partnerships” (LLP Law).

[5] The key legislative acts regulating activities of companies organized in forms of a limited liability company and a joint stock company are as follows: the Civil Code of the Russian Federation, Federal Law No. 14-Ф3 dated 8 February 1998 “On Limited Liability Companies” and the Federal Law dated December 26, 1995 “On Joint Stock Companies”.

[6] Thus, for example, according to Article 2.4 of the Code of the Russian Federation on Administrative Offences (Russian Code of Administrative Offences) managers and other employees of organizations, arbitration managers that committed administrative offenses in a course of implementation of organizational-management or administrative functions, as well as members of the board of directors (supervisory boards), collegial executive bodies (management boards, directorates), accounting commissions, audit commissions (auditors), liquidation commissions of legal entities and executives of organizations exercising the powers of sole executive bodies of other organizations, individuals who are founders (participants) of legal entities, executives of organizations exercising the powers of the sole executive bodies of organizations that are founders of legal entities that committed administrative offenses in cases envisaged by the Code of Administrative Offences shall be subject to administrative sanctions as officers.

[7] According to Article 201 of the Criminal Code of the Russian Federation, a person exercising management functions in a commercial or other organization is the person exercising the powers of the sole executive body, the member of the board of directors or other collegial executive body, as well as the person permanently, temporarily, or by special authority exercising the organizational-management or administrative functions in those organizations.

[8] According to the Explanatory note to part 3 of Article 285 of the Criminal Code of the Russian Federation, officers are the persons permanently, temporarily, or by special authority exercising functions of state official or executing organizational-management or administrative functions in government bodies, local government bodies, state and municipal enterprises, state corporations, state companies, state and municipal unitary enterprises, joints stock companies controlling shares in which are held by the Russian Federation, constituent territories of the Russian Federation or municipal units, also in Armed Forces of the Russian Federation, other military forces and military units of the Russian Federation.

[9] Law of the Republic of Kazakhstan dated 7 March 2014 No. 176-V “On rehabilitation and bankruptcy” (Bankruptcy Law).

[10] Code of the Republic of Kazakhstan on administrative offences dated 5 July 2014 No. 235-V (Code of Administrative Offences).

[11] Criminal Code of the Republic of Kazakhstan dated 3 July 2014 No. 226-V (Criminal Code).

[12] Civil Code of the Republic of Kazakhstan (General Part) dated 27 December 1994 (Civil Code)

[13] It would be helpful if the Supreme Court summarizes the practice on application of respective rules.

[14] For example, in Resolution of the Plenary Session of the Supreme Arbitration Court of the Russian Federation No. 62 dated 30 July 2013 “On Some Issues of Compensation of Damages by Persons Comprising Bodies of a Legal Entity.”