Recent Regulatory Developments Relating to Intermittent Renewable Resources Integration in California: Challenges and Opportunities

April 02, 2014Starting in 2002, California passed a series of laws, now known as the Renewables Portfolio Standard (“RPS”), requiring the State’s electrical utilities to procure increasing proportions of eligible renewable resources1 to serve their retail load. What began as a 20 percent RPS requirement by 20172 has evolved into a 33 percent target by 2020 for all California retail sellers of electricity.3 Although there are no further RPS mandates, the California Public Utilities Commission (“CPUC”) has authority to increase the RPS targets for utilities under its jurisdiction. In light of California’s long-term goal of reducing greenhouse gas (“GHG”) emissions to 80 percent below 1990 levels by 2020,4 there is a very real possibility that the CPUC will exercise this authority.

Integrating renewables into California’s aging transmission and distribution system has not been without its challenges. The grid has been designed primarily to handle traditional energy sources — e.g. natural gas, hydroelectric, and nuclear — which either generate power all the time, or can be spun up or down in response to load. The intermittency of wind and solar photovoltaic (“solar PV”) generation — which typically lacks coincidence with load and are estimated to dominate the renewable resource portfolio in 2020 — throws a wrench into this design. Two of the largest concerns are evidenced by the now famous — or infamous — “Duck Chart,” and a less famous, but equally cautionary chart we’ll refer to as the “Sunrise Chart.”

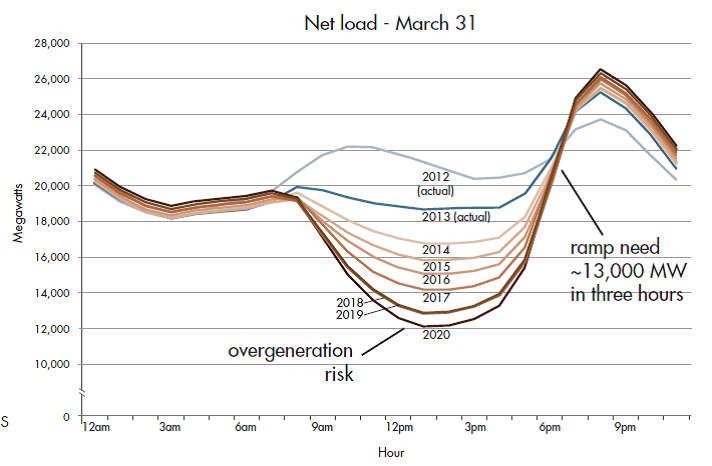

The Duck Chart, see Figure 1, was produced by the California Independent System Operator (“CAISO”). It shows that there is a risk of overgeneration as the mix of daytime generation becomes increasingly dominated by solar PV as we move towards 2020. It also highlights the need for substantial amounts of fast-ramping flexible generation when, as solar PV generation falls off steeply in the afternoon hours, early evening demand is on the rise.

Figure 1: “Duck Chart”

Source: CAISO5

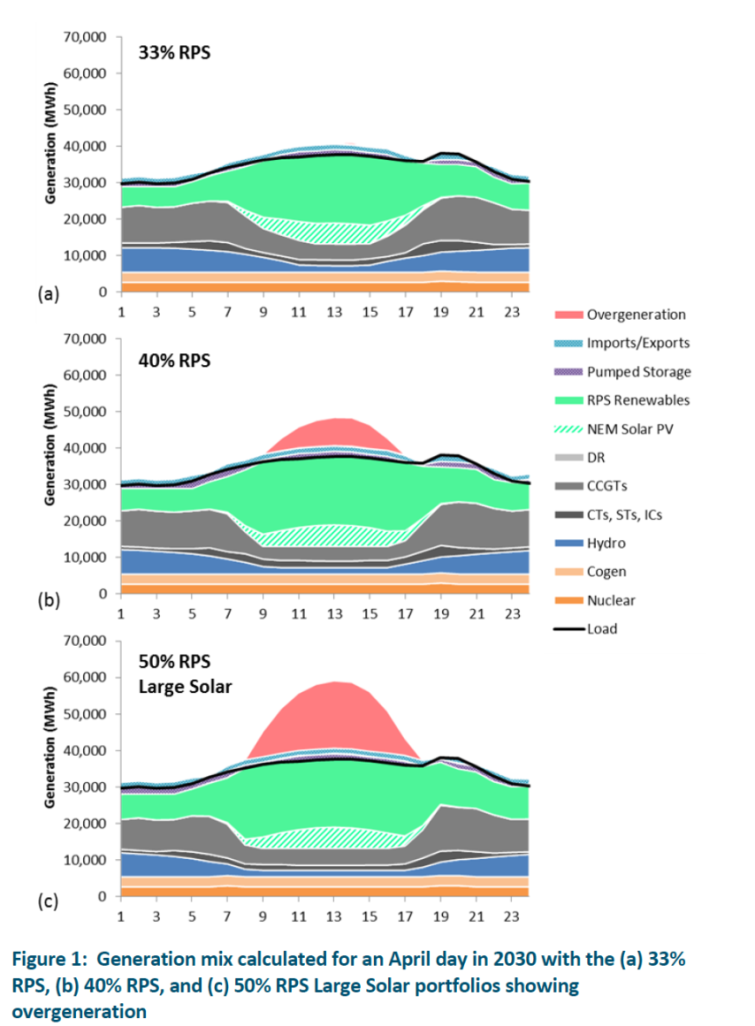

The Sunrise Chart, see Figure 2, was produced by Energy + Environmental Economics (“E3”) and shows the results of a study prepared for California utilities regarding the impacts of increasing the RPS requirements. It warns of the potential for overgeneration during daylight hours, a problem that worsens should California move from a 33 percent RPS to a 40 percent or 50 percent RPS.6 Because certain generation resources must run 24 hours per day, and there will be large amounts of solar PV coming online, the Sunrise Chart reveals the increasing threat that renewable generation will be subject to substantial curtailment, despite the high costs ratepayers bore to develop these projects. E3 estimates that at a 50 percent RPS, close to 10 percent of all RPS-eligible generation may be curtailed unless potential solutions are implemented.7

Figure 2: “Sunrise Chart”

Source: Energy + Environmental Economics, Investigating a Higher Renewables Portfolio Standard in California, 2014, available at https://ethree.com/public_projects/renewables_portfolio_standard.php.

Together, these charts evidence a fundamental dilemma: how can California meet its renewable goals cost-effectively, while maintaining grid reliability? Although neither the CPUC procurement planning proceedings nor the CAISO transmission planning proceedings have adopted mechanisms designed to address these challenges head on, these regulatory bodies are coordinating with each other more closely, and, as discussed below, are making progress toward addressing renewables integration issues.

CPUC Hints at Adopting a Non-Zero Integration Adder

One of the reasons California finds itself in this dilemma is that to date, the Commission’s renewable resource least-cost best fit (“LCBF”) bid evaluation methodology is based in part on the fiction that all renewables are created equal. It does not account for the disparate impact that intermittent energy sources like wind and solar PV have on the grid as compared to geothermal and solar technologies that include storage, for example. Intermittent resources require substantial flexible ramping resources so that the grid can accommodate the relative unpredictability of wind and solar generation. While the CPUC has included an integration cost adder in the LCBF bid evaluation methodology, for the moment this adder is merely a placeholder, as the CPUC has yet to approve the use of a non-zero value for this metric.8 However, a March 26, 2014 Commission ruling regarding the 2014 RPS procurement plans identifies a number of questions intended to clarify how an integration adder may be used, with the hope of opening “additional dialogue and record development on this issue,” and coming to a decision on the issue “in this proceeding, the LTPP proceeding, or another appropriate venue to be determined.”9 Ideally, such an adder would reflect the particular integration challenges presented by a renewable resource’s generation profile. Renewable generation developers should follow this attempt at leveling the playing field closely, whether developing intermittent resources or other renewables which may benefit from lower integration costs based on the criteria that may emerge.

The CAISO and CPUC are Slowly, But Increasingly, Acknowledging the Importance of Storage in California’s Energy Future

Another key to integration of large-scale renewables and the overgeneration problem will be procurement of substantial amounts of energy storage. The CPUC’s storage mandate, though still relatively small, has received a lot of attention recently. Together, California’s three largest investor-owned utilities are only required to procure 1,325 MW of storage by 2020 through a mix of customer-side, distribution-level, and transmission-level storage projects. The CPUC’s storage decision was meant to be technology forcing, as evidenced by the policy decision not to count large (i.e. greater than 50 MW) pumped storage projects towards the mandate, and to limit transmission-level storage to only 700 MW of the total 1325 MW authorized. Therefore, while the Commission continues to “strongly encourage the utilities to explore opportunities to partner with developers to install large-scale pumped storage projects where they make sense within the other general procurement efforts,” such storage must compete within the categories that include preferred resources.10

For pumped storage projects to be competitive, its benefits must be fully captured in the CPUC procurement process. Yet, the CPUC’s procurement methodology currently has no way to assess the benefits that storage can provide the grid, such as addressing and resolving the overgeneration problem E3 identified in the Sunrise Chart. While pumped storage has the potential to act as generation, its greater value stems from its ability to provide upward and downward regulation and time-shift intermittent renewable resources. Until the Commission develops quantifiable criteria that developers can rely on to monetize these benefits, these projects will be difficult to finance. This is an important challenge the CPUC, working with the CAISO, must overcome.

One of the questions plaguing utility-scale storage developers has been: how will the CAISO treat interconnection requests from utility-scale storage? Under the current CAISO interconnection tariff, a 500 MW storage project is treated just like any other 500 MW power plant. Yet, unlike traditional generation, storage projects will not operate on top of existing generation. Instead, such projects are more likely to fill in the holes — charging when there is overgeneration, and discharging when there is too little. These grid reliability benefits should therefore result in a very different set of interconnection upgrades compared to a traditional 500 MW facility. On March 27, 2014, the CAISO established a new stakeholder initiative to define and facilitate interconnection of storage facilities under existing rules, and potentially develop new rules, representing an important first step to solving the problem. An initial stakeholder call is scheduled for April 7, and comments are due on April 21, 2014.

Energy Imbalance Market Could Reduce Integration Challenges

In February 2013, the CAISO and PacifiCorp agreed to develop an Energy Imbalance Market (“EIM”) to increase the regional coordination amongst Western United States balancing authorities. Although only the CAISO and PacifiCorp have agreed to participate at this time, NV Energy recently became an affiliate of PacifiCorp and has expressed interest in signing on as a participant as well.11

Participants in the EIM, scheduled to launch in October 2014, will be able to dispatch real-time short-term balancing resources from any generation facility within their respective balancing authority. This capability has the potential to provide several benefits that could relieve some of the integration challenges posed by increased renewable generation for a number of reasons. First, it broadens the geographic area from which load can be served. Theoretically, wind resources that pick up in the evening in states like Idaho or Wyoming could replace dwindling solar PV resources in the early evening hours on the west coast, and thus decrease the need for fast-ramping traditional resources. Second, the EIM could reduce the need for flexible resources by pooling these resources among participating balancing authorities. It is premature to speculate the impact the EIM may have on generation and transmission developers, but if it is successful, it may stimulate development of generation out-of-state and transmission into California.

Transmission Development Needed in the Wake of Renewable Procurement

The three major California IOUs have essentially completed their procurement to meet 33 percent by 2020. However, in order to meet 33 percent renewables, E3 estimates that California will need to invest another $6.5 billion in upgrading its transmission system.12 The CAISO’s new competitive solicitation process therefore presents an opportunity for non-utility developers to enter the California transmission development markets.

On March 20, the CAISO Board of Governors approved the 2013–2014 Transmission Plan, which includes five new transmission projects for which there will be competitive solicitations. Eligible projects include those whose benefits outweigh their costs (“Economic Elements”), and those required to meet the State’s adopted RPS targets and other statewide policy objectives (“Policy-Driven Elements”). The CAISO’s project sponsor selection process uses a multi-factor test that essentially determines which applicant is best able to build, maintain, and operate the transmission element cost-effectively and reliably, while minimizing risks associated with delay, abandonment, and operational issues. Of note is that the CAISO has not required project sponsors either to have secured rights of way, or to have eminent domain authority. Nonetheless, the ability to secure rights of way, and experience doing so, is a factor the CAISO takes into consideration. Therefore, independent transmission developers wishing to avoid regulation as a public utility will likely benefit from partnering with utilities and/or municipalities in a competitive bid to bolster their ability to secure rights of way.

This benefit is evident in the CAISO’s recent sponsor selections for three transmission projects up for competitive solicitation in the 2012–2013 Transmission Plan. For the new Imperial Valley Substation, the CAISO chose the Imperial Irrigation District, a California municipality not within the CAISO balancing authority. For the second project, a 230 kV line connecting Gates to Gregg in PG&E’s territory, the CAISO chose a sponsor group including PG&E, Mid-American, and Citizens. Finally, for a 230 kV line connecting Sycamore to Panasquitos in SDG&E’s territory, the CAISO selected a joint venture between SDG&E and Citizens Energy.

Conclusion

California’s aggressive GHG reduction policies pose formidable challenges to the State’s energy regulatory agencies, and the resulting regulatory uncertainty has been frustrating for developers. However, recent developments demonstrate that the CAISO and CPUC acknowledge and are committed to addressing renewables integration challenges in California. The steps taken regarding storage are preliminary to date. That said, storage developers have the opportunity to shape how utility-scale storage will be evaluated and interconnected. Similarly, much can and will be learned in these early stages of the CAISO’s competitive solicitation process and the pending expanded EIM, both of which are likely to provide opportunities for entities seeking to invest in California’s energy future for the first time.

Contacts

If you have any questions or would like more information on the issues discussed in this LawFlash, please contact any of the following Morgan Lewis lawyers:

William Kissinger

Monica Schwebs

1 Eligible renewable resources include a large variety of resources ranging from biomass to geothermal to wave technology. Large hydroelectric resources (plants generating over 30 MW) are not RPS eligible resources. See Renewables Portfolio Standard Eligibility Guidebook: Seventh Edition, California Energy Commission, April 2013, available at http://www.energy.ca.gov/2013publications/CEC-300-2013-005/CEC-300-2013-005-ED7-SF.pdf.

2 See Senate Bill 1078 (2002), available at http://www.energy.ca.gov/portfolio/documents/documents/SB1078.PDF.

3 See Senate Bill 1X-2 (2011), available at http://www.leginfo.ca.gov/pub/11-12/bill/sen/sb_0001-0050/sbx1_2_bill_20110412_chaptered.pdf.

4 See Assembly Bill 327 (2013), available at http://www.leginfo.ca.gov/pub/13-14/bill/asm/ab_0301-0350/ab_327_bill_20131007_chaptered.pdf.

5 CAISO, “Fast Facts: What the duck chart tells us about managing a green grid,” available at http://www.caiso.com/Documents/FlexibleResourcesHelpRenewables_FastFacts.pdf.

6 A more detailed discussion of overgeneration can be found in Bingham’s January, 2014 Alert “Achieving California’s Greenhouse Gas Emissions Goals: New Study Exposes Overgeneration as Key Challenge to Increasing the Renewable Portfolio Standard,” available at http://www.bingham.com/Alerts/2014/01/Achieving-Californias-Greenhouse-Gas-Emissions-Goals.

7 See Energy and Environmental Economics, Investigating a Higher Renewables Portfolio Standard in California, 2014 (“E3 Report”),available at https://ethree.com/public_projects/renewables_portfolio_standard.php.

8 See CPUC Decision (“D”) 13-11-024, at 26-28, November 20, 2013 (declining to accept the use of non-zero integration cost adders in investor owned utilities’ 2013 RPS Procurement Plans, and noting that the impact on the grid of intermittent generation are being addressed in R.11-10-023, R.12-03-014, and elsewhere); CPUC Rulemaking 11.05.005, “Assigned Commissioner’s Ruling Identifying Issues and Schedule of Review For 2014 Renewables Portfolio Standard Procurement Plans” at 21, March 26, 2014.

9 CPUC Rulemaking 11.05.005, “Assigned Commissioner’s Ruling Identifying Issues and Schedule of Review For 2014 Renewables Portfolio Standard Procurement Plans,” at 21–22.

10 CPUC D.14-03-004 at 100-101, March 13, 2014.

11 See NV Energy letter to the CAISO, November 6, 2013 (available at http://www.caiso.com/Documents/Public_Comment-NV_Energy-EIM_Proposal.pdf) (encouraging approval of the EIM and stating that “participation by NV Energy in the EIM may benefit both California and Nevada customers”).

12 E3 Report at 24, Table 7, 2014, available at https://ethree.com/documents/E3_Final_RPS_Report_2014_01_06_with_appendices.pdf.

This article was originally published by Bingham McCutchen LLP.